KEY MARKET INFORMATION

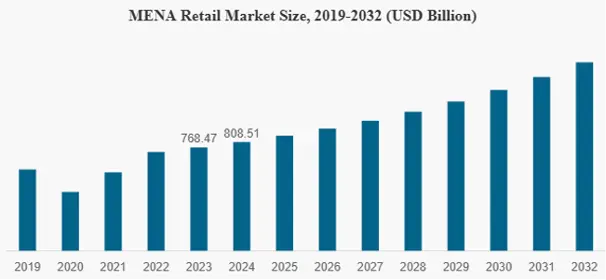

The MENA region covers a wide economic spectrum, from wealthy countries (GCC) to emerging economies such as Morocco. The retail market is a highly dynamic sector, influenced by a variety of factors (cultural, economic, technological, etc.). According to forecasts for the MENA region, this market will grow from around 800 billion USD in 2024 to over 1,400 billion USD by 2032. The factors that make this an extremely attractive sector range from technology adoption to government regulations. For example, in 2022 Amazon is bringing a new infrastructure development to the UAE that focuses on using cloud technologies to secure data, get work done, and provide local consumers with more choice and flexibility.

MENA RETAIL MARKET TRENDS

There are a growing number of AI-based platforms like CashMyStock that aim to drive the expansion of this sector. These platforms use AI to describe customer buying patterns, adapt to behavioral information and offer personalized recommendations. Thanks to AI and VR technologies, these platforms offer personalized experiences that help increase demand. Government support is also helping industry players to optimize their stock inventories. This is how platforms like CashMyStock are playing a key role in creating new opportunities for business growth in the Middle East region. There are several examples of government encouragement, such as the public-private partnership agreement signed by the Saudi Industrial Cities and Technology Zones Authority (Modon) in 2023, to develop 14 smart warehouses in Jeddah at the KSA.

WHAT FACTORS ARE DRIVING GROWTH IN THE MENA RETAIL MARKET?

Several factors are driving growth in the MENA retail market:

- The growing number of grocery stores offering all product categories in different ranges and prices, increases demand for products.

- Financial support from governments is also helping to develop infrastructure (number of stores, warehouses, etc.). For example, Apparel Group (a clothing company) expanded its presence in 2024 by opening 19 new stores in the UAE, KSA and Qatar.

- Another factor likely to trigger an increase in product demand is the influence of social media. In 2024, there will be around 5 billion users of these media, so more than half the planet. Media such as Facebook, Instagram, Youtube, TikTok and others, highlight the benefits of different consumer goods. This is helping to drive market growth between 2024-2032.

MENA RETAIL MARKET ANALYSIS

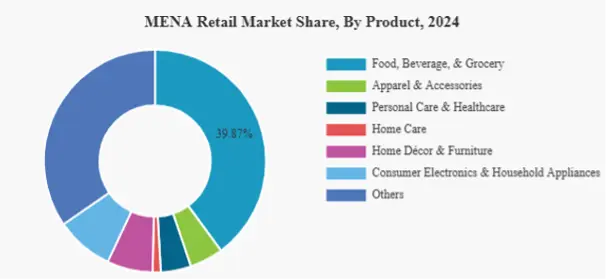

By 2023, the market will be dominated by the food segment. This is due to a number of reasons, such as the rapidly growing population, the increasing availability of suppliers of these goods, particularly food products based on natural and sustainable ingredients, and consumer preference for healthy foods.

Next comes the electronics and appliances sector, which is also expected to grow considerably between 2024 and 2032. This can be explained by the growing adoption of innovative electronic products such as smartphones, smartwatches, laptops... or by the increasing number of specialized electronics stores. By way of example, in 2023 Hisense International opened 2 production facilities, 3 flagship stores and several new offices in the GCC, Egypt and Algeria regions. These figures are reassuring for wholesale buyers from different parts of the world, and particularly from emerging economies such as Iraq and Kenya, who are looking for trusted wholesalers offering authentic, verified products. Cash My Stock, in fact, guarantees its customers an audit carried out on the brands, attesting to their authenticity.

In terms of retail channels, the supermarket/hypermarket segment dominates global market share for a variety of reasons, such as the growing demand for food and grocery products, in supermarkets such as Shoprite, Carrefour Group and Lulu Group International. At the same time, e-commerce is developing rapidly, offering a wide range of products. Industry players are relying heavily on e-commerce and online presence to remain competitive in the market. Several groups, such as Alshaya Group (a fashion company based in Dubai) are launching an application for American Eagle + Aerie, a clothing company based in the USA, Egypt and Qatar, in 2021.

Intense competition characterizes the MENA market. Leading players leverage their strong brand presence and loyalty to keep abreast of the competition. In recent years, market players have focused on expanding their online presence as one of their key strategies for staying competitive. For example, in June 2021, Alshaya Group, a fashion and distribution company based in Dubai, United Arab Emirates, launched a new app for American Eagle + Aerie, aimed at customers in Egypt and Qatar. Many other major groups operate in the region, including : Al Futtaim Retail, Magasins BinDawood, Groupe LuLu International, Groupe Chalhoub...

EXAMPLES OF INDUSTRY EXPANSION IN 2024

The industry is marked by key development dates. In 2024 alone, several major groups made business expansions:

- Alshaya Group inaugurates a new outlet: “Hampton by Hilton” in Kuwait, in lieu of 110 luxurious, modern outlets, including complementary hot breakfast and a fully equipped gym.

- Al-Futtaim launches its IKEA brand at the Dalma shopping mall in Abu Dhabi.

- Lulu Group International inaugurates a new hypermarket in Dubai Outlet Mall, offering products in several categories (food, electronics, household appliances, etc.).

- CHALHOUB GROUP signs a partnership with Inter Parfums, extending its presence in perfumery products in the Middle East.

- KSA-based BinDawood Stores presents its plan to open 7 supermarkets, hypermarkets and express stores during the year, with a view to expanding its presence in the main KSA cities.

SOME KEY ECONOMIC DEVELOPMENTS DRIVING MENA'S APPEAL FOR WHOLESALE BUYERS

- Construction of the Jeddah Tower: Jeddah Economic, a subsidiary of billionaire prince Alwaleed bin Talal's Kingdom Holding Company, has signed a USD 1.9 bn agreement with Saudi Binladin Group to take over construction of the Jeddah Tower, which will join the list of “mega skyscrapers” that includes the Burj Khalifa in Dubai, the Merdeka in Kuala Lumpur, the Shanghai Tower and the Clock Tower in Mecca. Its designer, American architect Adrian Smith, who also designed the Burj Khalifa, was inspired by desert plants.

- FCC Construction and Nesma sign construction contract for Qiddiya stadium: The contract for the construction of the Prince Mohammed bin Salman stadium, worth USD 1 billion, has been awarded to a joint venture between Spain's FCC Construction and Saudi Arabia's Nesma. It is a multi-purpose stadium, located at the top of a 200-metre cliff, with a capacity of 45,000 spectators. The stadium was submitted by Saudi Arabia as part of its bid to host the 2034 FIFA World Cup.

- Industry: NEOM announces USD 187 million concrete plant to support The Line project. The futuristic city project, The Line, is part of the NEOM gigaproject in north-western KSA. It will benefit from the opening of a new concrete plant worth 187 M USD. NEOM has teamed up with Saudi-based Asas Al Mohileb to develop the plant, which will produce 20,000 cubic meters of concrete per day. The Line project, was presented in 2017 as a 200-meter-wide linear smart city stretching over 170 km and covered by a mirrored structure that rises 500 meters above sea level.

- - Air: The KSA has added 60 direct routes since the launch of the Air Connectivity Program. This program has played a key role in the development of tourism. Saudi Arabia aims to establish itself as an international hub, thanks to its strategic location between Europe, Asia and Africa. Since the beginning of 2024, 12 new foreign airlines have established direct routes to Saudi Arabia, with an average of two to four new routes per country. By 2030, the country aims to establish direct connections to over 250 destinations and attract more than 150 million tourists.

- Agriculture: The Saudi Ministry of Environment, Water and Agriculture issues the first aeroponics license in the Middle East. This is the first operational license in the Middle East for a commercial agricultural project using aeroponics. This project will contribute to the agricultural needs of the local market through sustainable production. Aeroponics is a soil-less method of growing plants that reduces water consumption by 95% compared with traditional agricultural techniques, and enables year-round productivity. The KSA is a regional leader in sustainable agricultural solutions.

- - Startups in Dubai, Jeddah, Riydh and Abu Dhabi accounted for 85% of fundraising in the Middle East and North Africa in September, having raised 328.3M USD. The UAE offers acceleration programs and tax breaks, and Saudi Arabia offers significant investment in digital infrastructure, particularly in Riyadh and Jeddah.

- With 508 new projects, Dubai is ranked as the world's leading destination for greenfield FDI in the first half of 2024. Dubai comes ahead of London, Singapore and New York. Dubai alone accounts for 6.2% (by number) of projects launched worldwide.

- Energy, Industry & Services: the building permit for the Gulf's first casino is obtained by the American Wynn Resorts. The license to operate a “gaming establishment” in Ras al-Khaimah after having invested 514M USD to date in the project. According to Bloomberg, gaming revenues could reach 6.6 billion USD.

- UAE-based developer Modon Holding will be responsible for the Ras El-Hekma project, a new city planned for Egypt's Mediterranean coast. ADQ has acquired the development rights to the project for USD 24 billion and, as part of the agreement, is investing a further USD 11 billion in other projects in Egypt to support economic growth.

- Aecom, an American engineering company, is officially the consultant for the Hafeet rail project, which will link the UAE and Oman. The contract is estimated at 1.5 billion USD.

- Etihad Rail has teamed up with Emerge to install a large-scale solar photovoltaic system (600 kWp) and battery energy storage system (2.56 MWh) at its Ghuweifat freight terminal. The system will generate around 85% of the terminal's electricity needs.

- UAE-based developer Modon Holding will be responsible for the Ras El-Hekma project, a new city planned for Egypt's Mediterranean coast. ADQ has acquired the development rights to the project for USD 24 billion and, as part of the agreement, is investing a further USD 11 billion in other projects in Egypt to support economic growth.

- Aecom, an American engineering company, is officially the consultant for the Hafeet rail project, which will link the UAE and Oman. The contract is estimated at 1.5 billion USD.

- Etihad Rail has teamed up with Emerge to install a large-scale solar photovoltaic system (600 kWp) and battery energy storage system (2.56 MWh) at its Ghuweifat freight terminal. The system will generate around 85% of the terminal's electricity needs.

These examples are just a glimpse of the region’s rapid economic transformation, driven by ambitious infrastructure, innovation, and investment strategies. This dynamic growth is positioning the UAE and Saudi Arabia as leading sourcing hubs for wholesale buyers across Africa, Iraq, Kenya, and beyond. Platforms like CashMyStock are bridging the gap, making it easier than ever to access high-quality, affordable inventory from the heart of the MENA market.

Why UAE & KSA are the Top Wholesale Sourcing Hubs?